The United Republic of Tanzania becomes 34th shareholder of Africa50

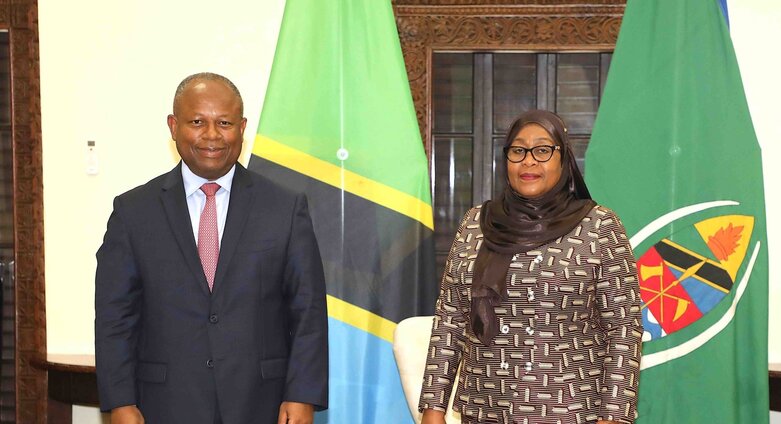

Alain Ebobissé, Africa50 CEO and Her Excellency Samia Suluhu Hassan, President of the United Republic of Tanzania during a courtesy call on her Excellency in Tanzania in 2022.

Alain Ebobissé, Africa50 CEO and Her Excellency Samia Suluhu Hassan, President of the United Republic of Tanzania during a courtesy call on her Excellency in Tanzania in 2022.Casablanca, 28 February 2023 – Africa50, the pan-African infrastructure investment platform, announced today that it has welcomed the United Republic of Tanzania as its 34th shareholder.

Dr. Mwigulu L. Nchemba, the Minister of Finance and Planning of Tanzania, signed the Share Subscription Agreement on behalf of the Government, committing Tanzania to take the necessary steps for ratification of the agreement, as required under the Articles of Association of Africa50.

Dr. Mwigulu L. Nchemba commented, “Tanzania is keen on developing its infrastructure to support the economic development of the country and we are pleased to join Africa50 as a shareholder to leverage their expertise to deliver the government’s priority infrastructure projects. Africa50 is already executing transformational projects across the continent, and we are looking forward to working closely on some strategic projects in our country”.

With this signing, Tanzania has become the fourth East-African country to join Africa50 as a shareholder, after Kenya, Rwanda and Djibouti and the 31st African country after Botswana in December 2022.

“There is an urgent need for African countries to increase investments in sustainable infrastructure to support economic development. Africa50 has proven to be a trusted partner, bringing key infrastructure projects from concept to bankability and from construction to operational delivery, and we are happy to have Tanzania as a shareholder and we look forward to supporting the country’s infrastructure development programme with our project development and finance expertise”, said Alain Ebobissé, CEO, Africa50.

Following Tanzania’s addition, Africa50 now has 34 shareholders, comprised of 31 African countries, the African Development Bank, the Central Bank of West African States (BCEAO), and Bank Al-Maghrib.

Africa50 has made 19 investments, with an aggregate value of over US$5 billion. In the energy sector alone, over 17 million people are accessing reliable and cleaner electricity as a result of projects financed by Africa50. In addition to its investments in energy, Africa50’s diverse portfolio of investments includes sectors such as transport and logistics, ICT, midstream gas, education, healthcare as well as fintech.

-ENDS-

About Africa50:

Africa50 is an infrastructure investment platform that contributes to Africa's growth by developing and investing in bankable projects, catalyzing public sector capital, and mobilizing private sector funding, with differentiated financial returns and impact. Bringing project development and financing together in one platform, we seek to provide support at every stage of the project cycle, through three investment vehicles:

Africa50 - Project Development: is dedicated to increasing the number of bankable infrastructure projects in Africa. It provides early-stage equity funding and project development and structuring capabilities and engages with stakeholders during the development phase to accelerate the process to financial close.

Africa50 - Project Finance: takes minority stakes in projects and invests equity and quasi-equity alongside strategic partners, with equity ticket sizes of below US$40 million, as well as in growth capital transactions.

Africa50 Infrastructure Acceleration Fund (IAF): the IAF is a recently launched private equity infrastructure fund that will take majority and minority stakes and invest equity and quasi-equity in operational businesses. It aims to catalyze further investment into African infrastructure by raising capital from African and global institutional investors.

Media Contact:

Africa50: Nana Boakye-Yiadom, Senior Communications Coordinator, Tel: +212666166308, n.boakyeyiadom@africa50.com

Category: Press Release